Car insurance isn’t the most exciting part of owning a car, but it is essential. Car insurance can protect you from financial loss in case of an accident and save you money in the long run.

Drivers can help reduce their rates by driving carefully and obeying traffic laws. They can also shop for the best policies and choose coverages that meet their needs.

Protects Your Car

Car insurance is an essential investment to ensure your car’s safety and protect you from significant expenses in case of theft or damage to your vehicle. It also covers any legal costs you may incur in case someone else gets injured in an accident you caused. Proper car insurance is crucial; you can check out the professionals at https://carinsurancecheap.net/ for assistance.

The type of vehicle you drive and its value can also impact your premium. Luxury and high-performance cars typically cost more to insure than cheaper models. In addition, external conditions, such as local weather patterns, traffic conditions, and the prevalence of certain kinds of claims, can influence rates.

Other factors affecting your premium include your driving record and credit history. A clean driving record and good credit can lower your insurance premium. In addition, shopping around and comparing policies will help you find the best deal on car insurance for your budget. Take advantage of price cuts and insurance incentives, as these can make a big difference in cost financial savings.

Protects Your Family

Some people may see car insurance as a waste of money, but it’s a worthwhile investment that can save you from huge losses should the unthinkable happen. It’s essential to find a carrier that isn’t only focused on price optimization and offers competitive monthly premiums but also provides excellent customer service during claims, helps you review your policy regularly and proactively, and enables you to choose the coverage that meets your needs. Using this service can avoid the hassle of dealing with high-pressure sales agents.

Protects Yourself

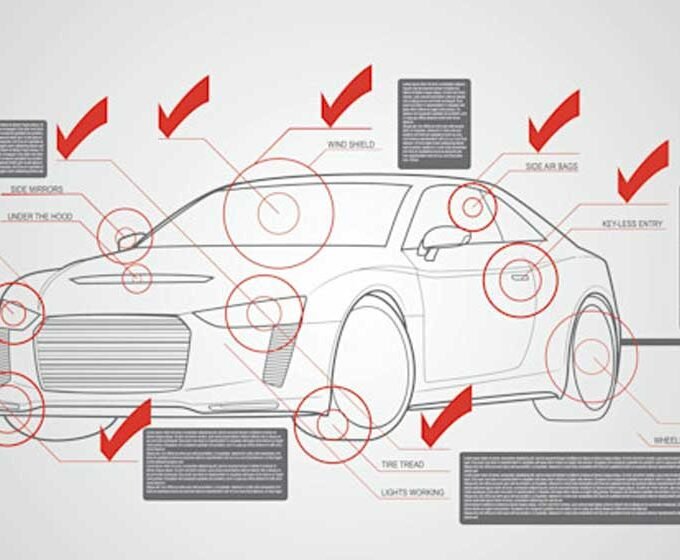

Quality car insurance protects you from huge expenses if you are involved in a severe accident. In addition to protecting your car and those of others, collision and comprehensive coverages protect you from medical costs and legal fees incurred due to an accident.

Having a good credit history and driving record will lower your premium. Shopping for the best rates every few years is a good idea. Many insurers engage in “price optimization,” trying to predict when you’re least likely to switch and squeeze a little extra profit from your loyalty.

While price should always be considered, it shouldn’t be the only factor in choosing an insurer. When searching for insurance companies, look for competitive prices and superior customer service. Additionally, consider their financial strength ratings and available coverage options.

Saves Money

Keeping your driving and credit records clean helps keep premiums low, but there are other ways to save money. You can get discounts for carpooling, loyalty to a particular company, or safety features. You may also save by going paperless, which can reduce your rate or make it accessible if you’re on an auto-payment plan.

If you are considering buying a new car, ask your insurer for a quote on your model. Your cars and high-performance vehicles generally cost more to insure than mainstream models.

If you have a lot of coverage, consider dropping unnecessary parts like roadside assistance or collision coverage for older vehicles that depreciate quickly. Likewise, review your policy and look at the deductibles to find a balance that suits your risk tolerance and budget. You can even save by agreeing to a higher deductible, which can lower the monthly premium.