Canada is known for its strong economy. It’s the reason many people believe investing here is a tremendous way to diversify one’s portfolio. With its stable financial system, low taxes, and strong currency, the country offers plenty of opportunities for investors.

The latest data shows that Canada is home to 1.21 million businesses. Of all the business types in the country, the most common are small businesses, making up 97.9 percent of the sector.

Despite this, there are also risks when investing in Canada. As an investor, you must know the potential pitfalls, from volatile markets to possible regulatory changes, before committing your money.

Opportunities for Investing in Canada

Various industries in the country offer great returns. Here are some worth investing in.

Technology

Canada’s tech industry is rapidly growing, with 43,200 companies falling under the information and communications technology sector. The industry is seeing positive growth, with revenue accounting for 5.3 percent of the national GDP. So, if you’re looking into tapping the Canadian market, tech is the industry that can bring you success.

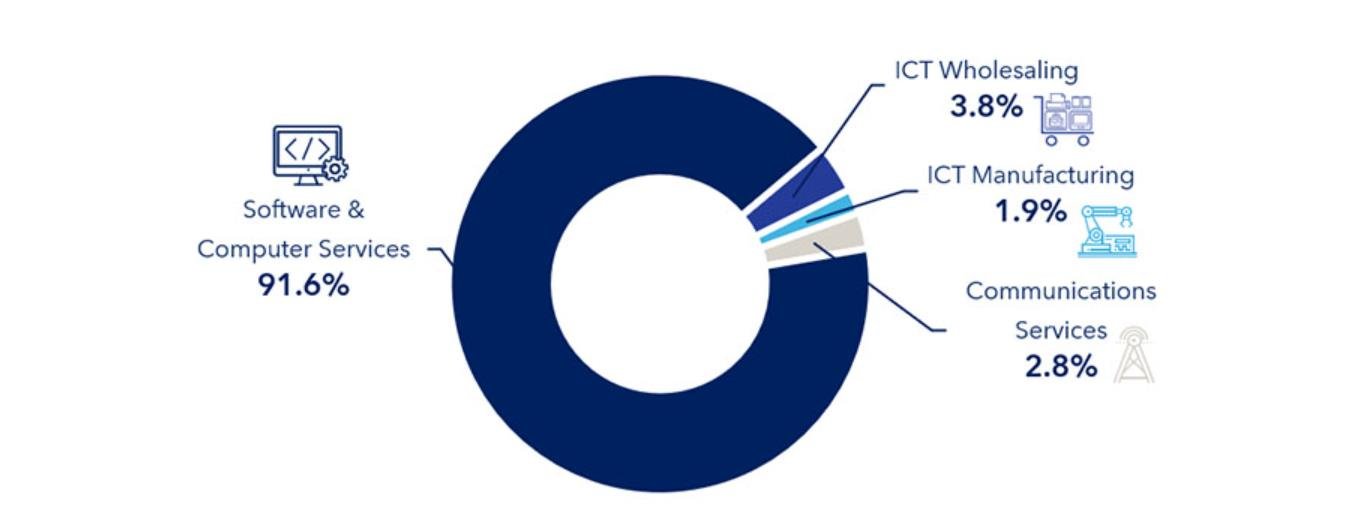

With cybersecurity and cloud services growing in demand in Canada, software and computer services (91.6%) make up most IT companies. The ICT manufacturing industry (1.9%) is one you should look into, as there isn’t much competition.

Renewable resources

With decarbonization demands increasing, businesses can tap into the opportunity of diving into renewable resources. In Canada, there’s a growing consensus that sustainability is the key to success. Organizations can explore modernizing energy infrastructure or invest in developing new technologies.

Since the country is on a journey to reach net-zero emissions by 2050, it’s a market worth investing in. Your business contributes to a greener economy and helps you enjoy a good return on investment (ROI).

Healthcare

The majority of Canada’s population belongs to the older generation. The number of people aged 85 is expected to reach 2.7 million by 2050. As such, the demand for healthcare facilities and services will concurrently increase. Demand for caregivers and nursing homes will also increase.

Risks To Consider When Investing in Canada

As any astute investor knows, there are always risks associated with investments. Here are some of them.

Regulatory changes

Specific sectors of the economy, such as the energy and mining sectors, can be more vulnerable to risks such as regulatory changes. It’s critical to stay updated with the latest changes to remain compliant.

Economic instability

While Canada’s economy is generally stable, it’s not immune to economic downturns. Factors such as government policies and demographic shifts can affect the economy. These events can lead to declining investment value in sectors susceptible to economic changes.

Geopolitical tensions

As a member of the global community, geopolitical tensions can impact the country’s economy and investment climate. Tensions between Canada and other countries will directly affect trade relations and create investor uncertainty.

Consider Strategies for Mitigating Investment Risks in Canada

Doing your homework is a must. An investor must study market trends and research opportunities before making huge investments. You can also work with a financial advisor to provide valuable guidance and advice for investors investing in Canada.

Advisors can file a voluntary disclosure application on your behalf. With a dedicated person handling your taxes, you don’t have to worry about taxes and penalties.

You should also stay current on news or events impacting the Canadian economy or investment climate.