College life brings a sense of freedom and independence, but it also introduces the challenge of managing finances for perhaps the first time. Financial wellness is crucial for a stress-free college experience. This 800-word article provides practical budgeting tips to help students navigate their finances effectively, ensuring a balanced and enjoyable college life.

Understanding Your Financial Situation

The first step towards financial wellness in college is to have a clear understanding of your financial situation. This means knowing how much money you have, where it comes from, and where it needs to go. List your income sources, including parental support, part-time jobs, scholarships, or student loans. Then, list your expenses, categorizing them into essentials like tuition, housing, food, and transportation and non-essentials like entertainment and hobbies. This clarity is the foundation for building a solid budgeting plan. If you order college papers online, don’t forget to add this to your list of expenses. Also, compare the prices of your service to other online providers. Research “Who can rewrite my essay for cheap” and view the available choices. Remember only to use services that offer free writing samples so that you can check their quality.

Creating a Realistic Budget

With a clear understanding of your finances, the next step is creating a realistic budget. A budget is a financial plan that allocates your income towards various expenses. Start by prioritizing essential expenses, ensuring that your basic needs are covered. Then, allocate some of your income to savings – even a small amount can add up over time. Allocate the remaining funds towards non-essential but meaningful activities. Remember, a budget shouldn’t feel like a constraint but rather a tool to help you enjoy your college life without financial stress.

Tracking Your Spending

Keeping track of your spending is crucial in sticking to your budget. Fortunately, there are numerous apps and tools available that can simplify this process. These apps categorize your expenses, alert you when you’re close to exceeding your budget, and provide insights into your spending habits. Alternatively, a simple spreadsheet can also be effective. Regularly reviewing your spending helps you stay on track and adjust your budget as needed.

Seeking Financial Resources and Advice

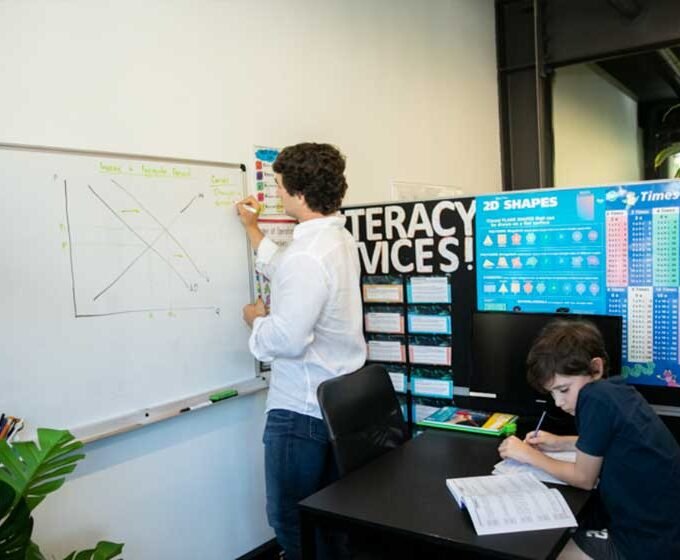

Many colleges offer financial literacy workshops, counseling services, and resources to help students manage their finances. Take advantage of these resources to learn more about budgeting, saving, and investing. Additionally, don’t hesitate to seek advice from financially savvy friends, family members, or mentors. Learning from others’ experiences can provide valuable insights and tips for managing your own finances. You can also get financial education online. You can see here to learn more about the trends in financial education.

Saving and Emergency Funds

One key aspect of financial wellness is having savings, particularly an emergency fund. An emergency fund is a reserve of money set aside for unexpected expenses, like a sudden trip home, a laptop repair, or medical emergencies. Start by setting a small, achievable savings goal and gradually increase it as your financial situation allows. This fund provides a safety net, reducing stress and giving you peace of mind.

Making Smart Spending Choices

Being a smart spender doesn’t mean cutting out all the fun; it means making informed choices. Look for student discounts, widely available for everything from software to entertainment and travel. Instead of eating out frequently, learn to cook simple, healthy meals – it’s cheaper and healthier. When it comes to shopping, differentiate between wants and needs, and prioritize spending on things that add value to your life.

Managing Credit Wisely

Credit cards can be a double-edged sword in college. They’re useful for building credit history but can lead to debt if not managed wisely. If you use a credit card, select one with low interest and no annual fee. Always pay your balance in full each month to avoid interest charges and late fees. Remember, restraint and responsible spending are key to using credit cards wisely.

Conclusion

Financial wellness is an integral part of a successful and stress-free college experience. You can confidently navigate your college years by understanding your financial situation, creating a realistic budget, tracking your spending, saving for emergencies, making smart spending choices, managing credit wisely, and seeking financial advice. Remember, the habits you form during college regarding money management can set the foundation for your financial well-being long after graduation.

Author: William Fontes

William Fontes is a skilled article writer and experienced financial adviser known for translating complex financial concepts into clear, reader-friendly content. His expertise in personal finance and investment strategies is reflected in his engaging and informative articles. Dedicated to empowering readers with practical financial advice, William’s writing simplifies the journey towards financial literacy and stability.