Addiction inflicts a significant toll on individuals, families, and society. Beyond the emotional and physical devastation, addiction also comes with a heavy financial cost.

Treatment is expensive, often prohibitively so, presenting a major barrier to recovery. Health insurance can be a lifeline, helping to defray the costs and make treatment accessible.

This article explores the financial realities of addiction treatment, how insurance can help, and tips for maximizing coverage.

Skyrocketing Costs Shut Out Many From Addiction Treatment

The costs of addiction treatment have risen to astronomical rates that place life-saving care out of reach for countless people. According to data from the Substance Abuse and Mental Health Services Administration (SAMHSA), between 1998 and 2008 the monthly cost of inpatient rehab soared 46% to over $10,900 while outpatient treatment jumped 24% to $1,429 per month. And the rapid inflation persists – since 2008, costs have continued escalating between 5-15% annually across substance abuse programs.

The metrics demonstrate the runaway prices:

- Inpatient rehab now runs from $6,000 to $20,000 monthly.

- Outpatient treatment averages around $5,000 per month.

- Medication-assisted treatment varies, ranging from $500 to $2,000 monthly.

A standard 30-to-90-day inpatient stay can thus cost up to $60,000 – equivalent to the average US household income. Out-of-pocket, customers pay approximately $1,500 monthly.

At rates doubling every 10-15 years, high-quality addiction treatment has transformed into a luxury good – attainable only by the wealthy few. Meanwhile, over 20 million Americans battle the life-threatening disease of addiction. This reality represents a moral failure. With lives on the line, making substance abuse programs affordable merits urgent policy attention to prevent millions more preventable deaths.

When exploring local options, it’s crucial for individuals to consider factors like the program’s structure, duration, and offered services. According to recent data, the average expense for drug rehab facilities in ohio fall within the range of $3,000 to $8,000 per month, reflecting the regional variations and specific program features.

Some specific data points on rising addiction treatment costs:

- The cost of inpatient rehab rose from an average of $5,732 per month in 1998 to $10,909 per month in 2008.

- Outpatient treatment increased from $1,027 per month to $1,429 per month over the same period.

- By 2021, the average cost for outpatient treatment had reached approximately $2,000 per month, nearly doubling the 2008 rate.

- Top-tier luxury rehab facilities can now charge over $60,000 per month.

- Costs for medication-assisted treatment have also risen, with Suboxone film running $500-$1,200 per month without insurance.

- The overall cost of alcohol addiction treatment increased by 130% between 2004-2017.

Several factors drive these increasing expenses:

- Highly trained specialists and staff.

- Comprehensive, customized programming.

- Luxury amenities at some facilities.

- Administration, licensing, and stringent regulations.

- Lack of providers in some geographic areas.

- New treatment and medication options.

While costs are rising across healthcare, the rate of increase for addiction treatment has been especially steep — putting a huge financial strain on those seeking help.

The Devastating Financial Impact of Addiction

The prohibitive costs of rehab create a challenging Catch-22. On one hand, the financial fallout of addiction creates a desperate need for treatment. On the other, the expense can make it unattainable.

Active addiction takes an immense toll on personal finances:

- Lost income from inability to work consistently.

- Job loss from poor performance or attendance.

- Foreclosures, bankruptcy, evictions from failure to pay bills.

- Legal fees, and fines for drug-related offenses.

- Strained relationships damage the financial safety net.

- Medical bills from health impacts of chronic use.

- The cost of substances themselves.

In early recovery, these financial stressors remain while new treatment costs arise. It’s a perfect storm making rehab seem impossible despite urgent need.

Where Health Insurance Comes In

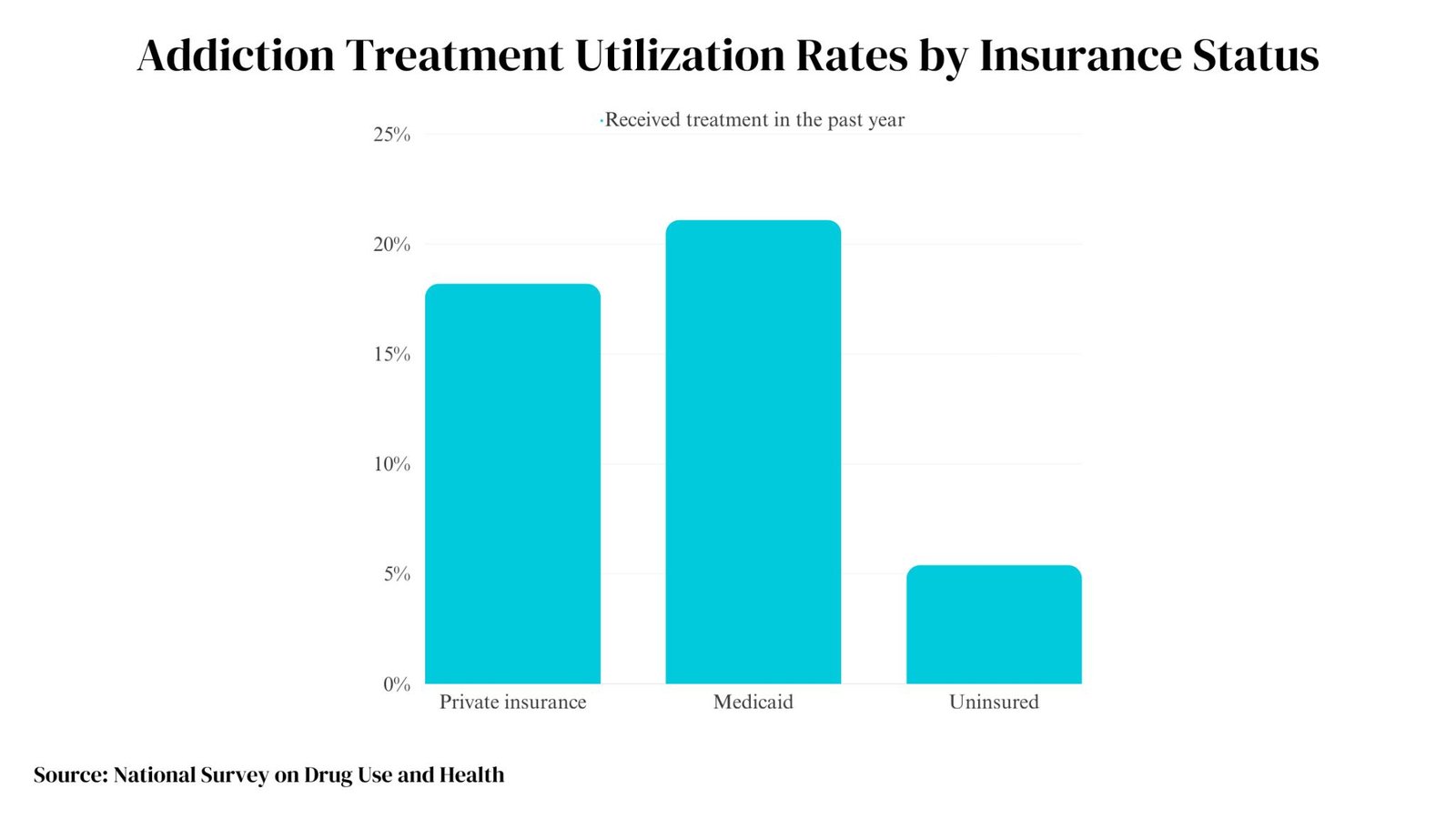

Insurance can provide a lifeline through this financial maelstrom. Given that substance use disorders impacted 20.3 million Americans in 2019 alone, health plans have become essential in financing treatment.

Here’s how insurance lightens the financial load:

- Lowers out-of-pocket costs: Policies cover some portion of treatment, reducing your own expenses.

- Provides access: Makes treatment a viable option you could not otherwise afford.

- Works with providers: In-network facilities contract rates with insurance companies.

- Unlocks other assistance: Public and private financial aid often requires insurance.

- Funds continuing care: Supports long-term outpatient services critical for recovery.

With insurance subsidizing costs, treatment becomes more accessible for the millions who urgently need help fighting addiction.

Maximizing Your Benefits

Navigating insurance benefits for rehab can be complex. Here are tips to optimize coverage:

- Know your policy details — deductibles, copays, preapprovals required, covered providers, etc.

- Choose in-network facilities to minimize out-of-pocket costs.

- Inquire about medical necessity reviews to ensure care meets the criteria.

- Discuss preauthorization early in the admissions process.

- Have the prescriber handle prior authorizations for any medications.

- Appeal any claim denials with help from the rehab billing department.

- Verify continuing coverage like outpatient therapy and support groups.

- Look into public assistance programs if insurance falls short.

With careful planning, you can stretch your benefits to reduce the cost barriers preventing many from getting addiction treatment.

Overcoming Common Insurance Challenges

Navigating insurance benefits for addiction treatment comes with many potential pitfalls. Being aware of common challenges can help you overcome them:

- Limited in-network options:

Some plans have few or no in-network addiction treatment facilities. This can be appealed or out-of-network exceptions requested.

- High out-of-pocket expenses:

After deductibles and copays, your share of costs may still be unaffordable. Compare out-of-pocket estimates across providers.

- Prior authorization denials:

Work closely with treatment staff and your prescriber to document medical necessity and appeal denials.

- Restrictive policies:

Inpatient days, outpatient visits, or medication doses covered may be inadequate for full treatment. Maximize all benefits and appeal for more coverage.

- No coverage for certain services:

If your plan excludes types of care like holistic therapy or medications, ask about alternatives covered.

- Confusing claims processes:

Billing staff at treatment centers can help navigate convoluted procedures around copays, preauthorization, denials, etc.

While daunting, these common challenges can be overcome through advocacy, appeals, assistance programs, policy exceptions, and aid from providers.

FAQs

How much does inpatient drug rehab cost with insurance?

With insurance, the out-of-pocket cost for inpatient rehab ranges widely but averages around $5,000 per month. Deductibles, copays, coinsurance, and other factors affect your share of the total bill.

What benefits typically cover addiction treatment?

Most private health plans and Medicaid cover substance abuse treatment. Typical services covered include inpatient rehab, outpatient counseling and therapy, medication, and some continuing care.

Does insurance cover luxury rehab facilities?

Coverage varies, but insurance typically only covers treatment deemed medically necessary, not luxury amenities. You may need to pay out-of-pocket for premium features.

Can I get financial assistance for rehab costs that insurance doesn’t cover?

Yes, many public and private organizations provide financial aid, loans, scholarships, and payment plans. Reach out to providers for assistance options.

Conclusion

Addiction fuels financial ruin, yet treatment seems out of reach even as it offers the sole path to regain stability. This cruel catch-22 bars countless from lifesaving help. However, insurance can help shatter the barriers.

With expansions under the Affordable Care Act, over 25 million people gained substance abuse coverage through employer plans, Medicaid, and individual marketplaces. Leveraging these benefits makes treatment possible.

While navigating insurance intricacies presents challenges, patient advocates help unlock maximum coverage. Financial assistance programs also cover remaining gaps so cost never blocks recovery’s door. With a mosaic of old and new resources, freedom from addiction no longer remains restricted to the privileged few.

Treatment and restored hope have become tangible for millions thanks to progress expanding access. The work continues, but for those still battling, the tools now exist to reclaim life’s promise. Healing awaits.